US:

In recent U.S. market developments, small-cap stocks saw notable gains, with the Russell 2000 Index surging 6.00% in its strongest week since November. Value stocks outperformed growth stocks across various indexes. Earnings season started with JPMorgan Chase, Wells Fargo, and Citigroup reporting, all seeing share declines on mixed results. Consumer prices fell for the first time since early 2020, with core inflation also slowing, which the market welcomed with varied reactions. The Federal Reserve’s response to these inflation trends remains cautious, potentially impacting future rate decisions. Bond yields fell after the CPI report, and the market showed resilience in high yield bonds and bank loans despite economic uncertainties

EU:

In Europe, stocks across major indexes saw gains with the STOXX Europe 600 rising 1.45% for the week, buoyed by favorable U.S. inflation data. France’s CAC 40, Italy’s FTSE MIB, Germany’s DAX, and the UK’s FTSE 100 also posted increases. Bond yields in France and Germany fell alongside U.S. Treasuries. In the UK, economic growth rebounded in May, prompting speculation on Bank of England policy. Meanwhile, wage growth in the euro area accelerated, potentially influencing ECB decisions. In politics, France faces coalition talks after a fragmented parliamentary election outcome.

Fund Performance:

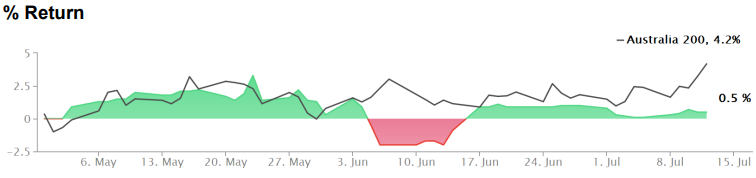

Returns relative to the ASX 200 Index.

The fund recorded a +0.37% increase for the past week. Mostly due to market expectations in New Zealand indicate potential rate cuts later this year, while Australian rates suggest the likelihood of cuts in 2025. Despite favorable inflation data in the U.S., opportunities in equities were overlooked. Systematic trading was halted due to signal quality failing to meet acceptable thresholds relative to available capital.