US:

In the U.S. stock market, performance was mixed for the second week in a row. Small-cap and value stocks outperformed large-cap growth stocks, with the Nasdaq Composite lagging behind the S&P 500 and Russell 2000 indices. A notable drop occurred midweek, with the S&P 500 falling over 2% and the Nasdaq experiencing its worst loss since October 2022. Key earnings reports, including declines in Tesla and Alphabet shares, contributed to this downturn, although overall S&P 500 earnings were predicted to rise by 9.8% year-over-year.

Economic indicators presented a mixed picture: new home sales fell below expectations, and manufacturing activity contracted. However, durable goods orders and consumer spending showed positive trends, and the economy grew at an annualized rate of 2.8% in Q2, driven by inventory building and government spending. Inflation data from the core PCE price index remained close to the Fed’s target, leading to increased expectations for a Fed rate cut in September. The 10-year Treasury yield decreased slightly, and the bond market saw stable activity with modest support for high-yield bonds.

EU:

In Europe, the STOXX Europe 600 Index rose 0.55% for the week, largely driven by a strong rally on Friday. Among major indexes, Germany’s DAX increased by 1.35%, the UK’s FTSE 100 gained 1.59%, while France’s CAC 40 and Italy’s FTSE MIB saw slight declines of 0.22% and 1.27%, respectively. European markets were pressured midweek by weak earnings in the technology and luxury goods sectors, influenced by poor performance in U.S. tech stocks.

Eurozone sovereign bond yields decreased due to weaker economic data and expectations of potential ECB rate cuts. Markets anticipated 50 basis points of rate cuts by the end of 2024. German bonds were favored as safe havens, while French and Italian yields widened due to ongoing fiscal concerns.

Fund Performance:

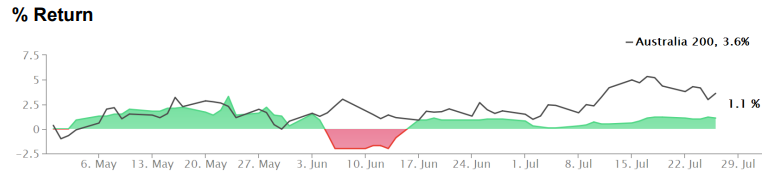

Returns relative to the ASX 200 Index.

Over the past week, trading activity was minimal due to illness and limited screen time this resulted in a weekly loss of -0.03%. Our position in Australian rates remains as a flattener with more hikes to be priced. Additionally we await further guidance from the Bank of Japan (BoJ), Bank of England (BoE), and Federal Reserve (Fed) to clarify the future direction of interest rates globally. This week, we will be focusing on key economic releases, including Australian Consumer Price Index (CPI) data and U.S. employment figures, to navigate the evolving market landscape.