US:

U.S. stock markets fell sharply last week as economic data and earnings reports from major companies led to investor uncertainty. Despite a broad performance in the S&P 500 Index, the small-cap Russell 2000 Index experienced a steep decline, while the Nasdaq Composite entered a technical correction. Earnings from major firms, including Microsoft, Meta Platforms, Apple, and Amazon, highlighted significant capital spending on AI, contributing to Amazon’s 11% drop in share price. Economic data showed slower job growth, with the economy adding only 114,000 jobs in July and the unemployment rate rising to 4.3%. The Institute for Supply Management’s manufacturing index also fell to its lowest level in nearly two years, further impacting market sentiment. Consequently, expectations for Federal Reserve rate cuts surged, driving long-term interest rates down and causing increased volatility in the bond markets.

EU:

The pan-European STOXX Europe 600 Index fell 2.92% last week amid concerns about global economic growth triggered by weak U.S. data. Major European indexes dropped significantly, with Germany’s DAX down 4.11%, France’s CAC 40 falling 3.54%, and Italy’s FTSE MIB declining 5.30%. The UK’s FTSE 100 decreased by 1.34%. UK gilt yields fell after the Bank of England cut its key interest rate by a quarter point to 5.00%, the first reduction since the pandemic began, although further cuts are uncertain. The European Central Bank is also expected to lower rates, leading to decreased German bund yields. Eurozone inflation rose slightly to 2.6% in July, while the region’s economy grew 0.3% in Q2, despite a contraction in Germany. The unemployment rate ticked up to 6.5%, but consumer confidence improved in July.

Fund Performance:

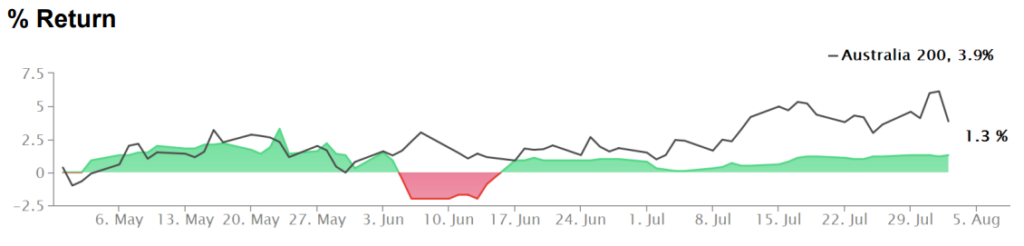

Returns relative to the ASX 200 Index.

The fund achieved a modest gain of +0.12%, successfully sidestepping the turmoil in rates and equities that followed the release of US employment data and Australian CPI figures. Currently, our position remains neutral as we await new trading opportunities. Upcoming events such as the RBA decision, New Zealand employment and inflation data, and employment reports from the US and Canada will be key focal points for potential trades.