US:

U.S. markets experienced volatility driven by concerns over economic growth, technical factors, and programmatic trading. Major indexes, including the S&P 500 and Nasdaq Composite, approached correction territory, while the CBOE Volatility Index (VIX) spiked to its highest level since March 2020 before settling lower. The fluctuations were partly attributed to unwinding of carry trades due to rising Japanese interest rates and short covering. Mixed signals on consumer strength emerged, with companies like Airbnb and Disney reporting weaker demand, while some economic indicators like S&P Global’s services sector activity remained solid. Jobless claims fell, providing a brief market rally. Treasury yields rose, while the municipal and corporate bond markets faced challenges amidst the broader market turbulence.

EU:

European markets showed mixed results, with the STOXX Europe 600 Index ending the week slightly higher, recovering earlier losses. Germany’s DAX and France’s CAC 40 saw modest gains, while Italy’s FTSE MIB declined. Eurozone government bond yields rose amid concerns about global economic growth, which were tempered by a drop in U.S. jobless claims. Retail sales in the eurozone fell unexpectedly, indicating consumer struggles amid inflation. In Germany, industrial output and orders exceeded expectations, but the trade surplus shrank due to weaker demand. In the UK, housing market sentiment improved, with rising house prices and increased buyer interest, aided by lower interest rates and government support for residential development

Fund Performance:

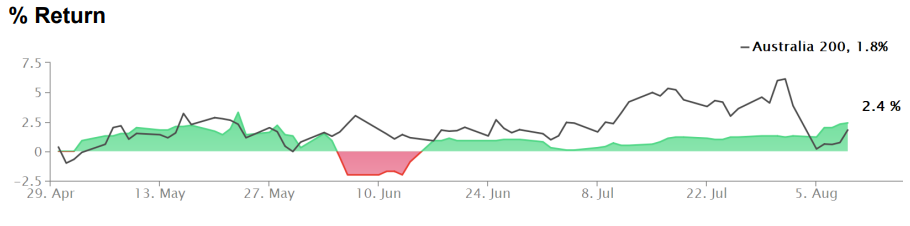

Returns relative to the ASX 200 Index.

The portfolio achieved a +1.01% gain for the week, largely driven by exploiting mispricing in short-term U.S. rates amid increased volatility. In the upcoming week, key data releases include Australian wage growth, the Reserve Bank of New Zealand’s decision, and U.S. CPI figures.