US:

Stocks posted solid gains for the week, fueled by positive news on inflation and growth, raising hopes of a “soft landing” for the economy. The Nasdaq Composite, driven by strong performances from tech stocks like NVIDIA, which surged nearly 19%, led the rally. Growth stocks outpaced value shares, with consumer discretionary stocks also performing well—Starbucks jumped 24.5% after announcing a new CEO, and Walmart gained 6.58% on strong earnings and raised guidance. Retail sales showed their best growth in 18 months, while inflation data indicated stabilizing prices, boosting investor sentiment. However, housing data was weak, with building permits and housing starts falling to pandemic-era lows. In the bond market, Treasury yields decreased on inflation data but rose after strong retail sales, while corporate and high yield bonds benefited from improving risk sentiment.

EU:

The pan-European STOXX Europe 600 Index rose 2.46%, buoyed by growing expectations of interest rate cuts as early as September, with major indexes like Germany’s DAX, France’s CAC 40, and Italy’s FTSE MIB posting strong gains. In the UK, inflation increased slightly to 2.2% in July, but slower-than-expected growth in services prices and steady economic growth led markets to anticipate potential rate cuts later this year. The eurozone economy showed resilience with 0.3% GDP growth in the second quarter, despite industrial production underperforming. Meanwhile, Norway’s central bank held its key interest rate at 4.5%, signaling a steady outlook unless the economy weakens further.

Fund Performance:

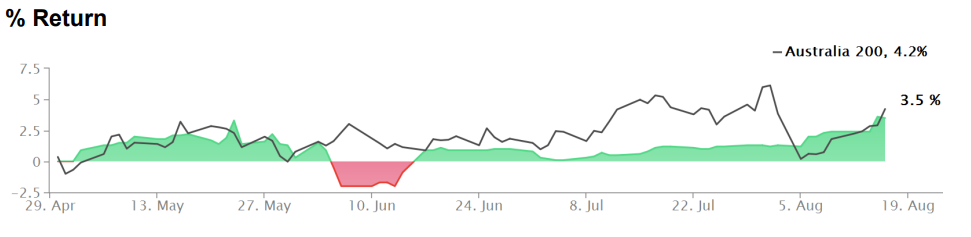

Returns relative to the ASX 200 Index.

The portfolio gained +1.12% for the week, driven primarily by returns from long-end rates in the US market. Looking ahead to the coming week, we will need to navigate key data releases and important speeches, particularly at the Jackson Hole Symposium.