US:

Investors cheered the prospect of upcoming interest rate cuts announced by Federal Reserve Chair Jerome Powell, pushing the Dow Jones Industrial Average and S&P 500 Index toward record highs, with broad-based gains led by small-cap stocks. Powell’s speech at the Jackson Hole symposium, hinting at possible rate cuts in September, especially a 50 basis point reduction, boosted market sentiment. However, less dovish comments from some Fed officials, including Kansas City Fed President Jeffrey Schmid, tempered enthusiasm later in the week. The release of Fed meeting minutes, showing strong support for rate cuts, and an 818,000-job downward revision in payroll data—marking the largest such revision since 2009—led to lower bond yields and a rally in Treasuries. Meanwhile, economic data largely met expectations, with manufacturing remaining weak but services continuing to grow, while existing home sales broke a four-month decline. Despite lighter trading volumes and an active municipal bond market, investment-grade corporate credit aligned with broader market trends, and high yield markets saw balanced flows and subdued issuance amid an end-of-summer slowdown.

EU:

The pan-European STOXX Europe 600 Index rose 1.31% amid growing expectations of interest rate cuts from the Fed and ECB, with major indexes in Germany, France, Italy, and the UK also advancing. Eurozone business activity improved in August, driven by a boost from the Paris Olympics, although manufacturing continued to contract for the 17th consecutive month. Wage growth in the eurozone slowed, and Germany’s economic recovery was further delayed by weak foreign demand. ECB officials, including Olli Rehn and Fabio Panetta, supported a rate cut in September, with some suggesting more cuts could follow. Meanwhile, Sweden’s Riksbank reduced its key policy rate and signaled further cuts, while UK business activity accelerated, with private sector output expanding at its fastest pace since April.

Fund Performance:

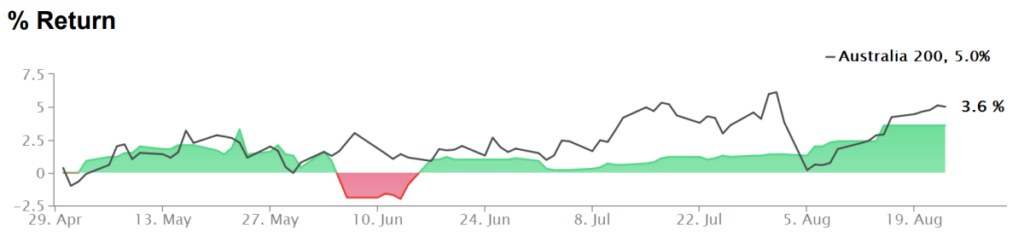

Returns relative to the ASX 200 Index.

The portfolio saw limited trading activity ahead of the Jackson Hole symposium later in the week, closing with a modest gain of +0.02%, marking the fourth consecutive week of positive returns (+0.12%, +1.01%, +1.12% and +0.02%). Looking ahead, we plan to marginally increase risk exposure as we target monthly gains exceeding 2%. Our focus for the coming week will be on Australian Retail Sales and CPI data, with attention also directed toward the U.S. PCE reading.