US:

U.S. stocks ended mixed in light trading ahead of the holiday weekend, with the Nasdaq Composite underperforming due to a significant drop in NVIDIA shares. Value stocks outpaced growth stocks, marking the largest margin since July. Economic data, including a lower-than-expected increase in the core PCE price index, reassured investors about subdued inflation, while personal income and spending showed resilience. However, the housing sector continued to struggle, with pending home sales falling sharply due to affordability concerns. Treasury yields drifted higher, and the municipal bond market was active, while corporate bonds remained quiet.

EU:

Europe’s STOXX Europe 600 Index hit a record high, continuing a four-week rally driven by declining inflation, which supports the possibility of an ECB rate cut in September. Major European indexes, including Germany’s DAX and Italy’s FTSE MIB, saw significant gains. Eurozone inflation dropped to 2.2%, nearing the ECB’s target, although some policymakers remain cautious about lowering rates. While overall economic sentiment in the euro area improved, German business confidence declined sharply. Additionally, the UK housing market strengthened with increased mortgage approvals and rising house prices.

Fund Performance:

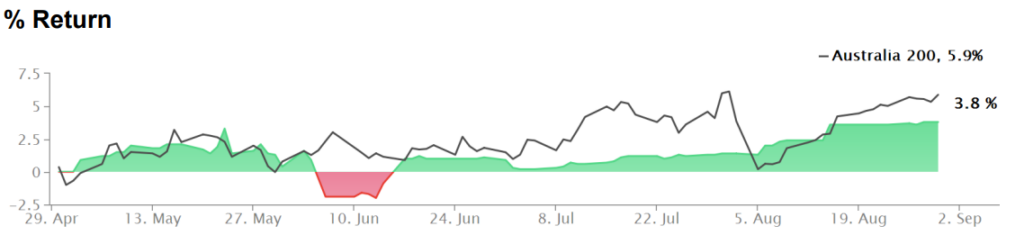

Returns relative to the ASX 200 Index.

The portfolio gained 0.17% for the week, bringing the total return for August to 2.3%. It was a quiet trading week ahead of the upcoming U.S. employment data. We will look to adjust the portfolio’s risk parameters and plan to increase position turnover to enhance returns going forward.

Additionally, we are seeking extra capital to improve margin usage and reduce the impact of fixed fees on overall performance.