US:

U.S. stocks rebounded after a steep sell-off, with growth stocks, particularly in the technology sector, outperforming value shares. NVIDIA’s positive outlook on artificial intelligence contributed to the gains. Core inflation rose slightly higher than expected in August, but a decline in headline inflation and lower mortgage rates offered some optimism for the housing sector. Treasury yields reached year-to-date lows, while the investment-grade corporate bond market remained stable, and high-yield bonds performed well, supported by strong equity gains and expectations of a Fed rate cut.

EU:

The European Central Bank (ECB) cut its deposit rate by 0.25% to 3.5%, citing weakening economic growth and slowing inflation in the eurozone but offered no clear guidance on future rate moves. Core inflation projections were revised slightly higher, and economic growth forecasts were lowered for the coming years. Economist Tomasz Wieladek expects the ECB to remain cautious, with possible quarterly rate adjustments. In the UK, GDP stagnated for the second consecutive month, and while pay growth eased to 5.1%, it remains well above the Bank of England’s target for controlling inflation.

Fund Performance:

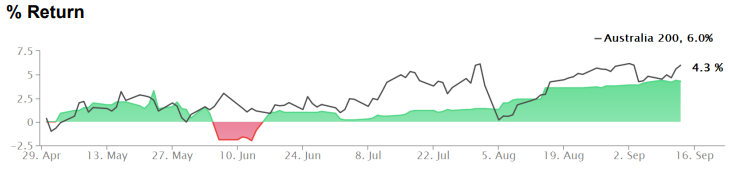

Returns relative to the ASX 200 Index.

The performance for the week was +0.09%, marking the seventh consecutive week of positive gains and bringing the total returns for September to +0.38%. We anticipate strong trading in the second half of the month, especially after the US Federal Reserve initiates the first move in its rate-cutting cycle.