US:

Stocks reached new highs as investors celebrated the Federal Reserve’s decision to initiate a rate-cutting cycle with a larger-than-expected 50 basis point cut, marking the first since March 2020. While large-cap indexes hit record levels, small-caps, like the Russell 2000, outperformed but remained below past highs. Economic data suggested consumer strength, with retail sales rising and jobless claims falling, though housing data was mixed. Bond yields rose modestly, and corporate bond spreads tightened as demand increased, buoyed by the Fed’s cut. The high-yield market strengthened as risk appetite returned following the rate decision.

EU:

The Bank of England (BoE) kept its key interest rate at 5.0%, with an 8–1 vote, citing the need for a cautious approach to policy easing despite unchanged headline inflation at 2.2% in August. Service price inflation, a key focus due to wage pressures, rose to 5.6%. Norges Bank also held its rate steady at 4.5%, with no expected changes through year-end. Meanwhile, hawkish European Central Bank (ECB) officials advocated for a gradual policy easing approach, with inflation still a concern. Eurozone labor costs moderated, growing 4.5% annually through June, down from 5.2% previously.

Fund Performance:

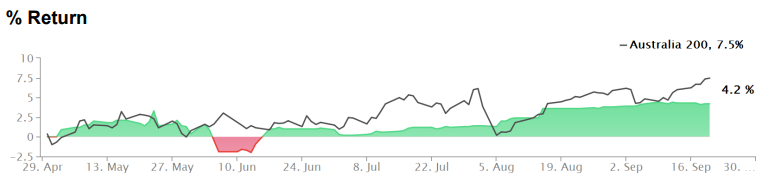

This week’s performance slipped slightly after trading higher volumes as I increased both risk and the duration of exposure, ending with a -0.09% return and breaking a seven-week streak of gains. We are aiming to continue increasing risk to help offset platform costs, with our primary goal being capital preservation. Additionally, we are seeking more capital to further mitigate the impact of fixed costs on our operations.