US:

Stocks reached record highs, driven by optimism over new stimulus measures in China and strong performance in technology stocks, particularly AI-related companies like Micron and NVIDIA. Materials stocks also surged, supported by rising copper prices. Despite a sharp drop in U.S. consumer confidence and mixed housing data, benign inflation figures—core PCE rose just 0.1%—boosted markets, aligning with the Fed’s 2% inflation target. U.S. Treasury yields remained stable, while strong demand was seen in both municipal and investment-grade corporate bonds, supported by the positive macro backdrop.

EU:

Eurozone business activity contracted in September, with the composite PMI falling to 48.9 as new orders dropped and the boost from the Paris Olympics faded. Services nearly stalled, and manufacturing contracted further, with Germany experiencing its steepest decline in seven months. In contrast, UK private sector activity continued expanding, though at a slower pace, with a PMI of 52.9. German business confidence worsened, signaling a potential recession, while consumer sentiment remained weak. Meanwhile, Sweden and Switzerland both cut interest rates by 0.25%, responding to decreased inflationary pressures.

Fund Performance:

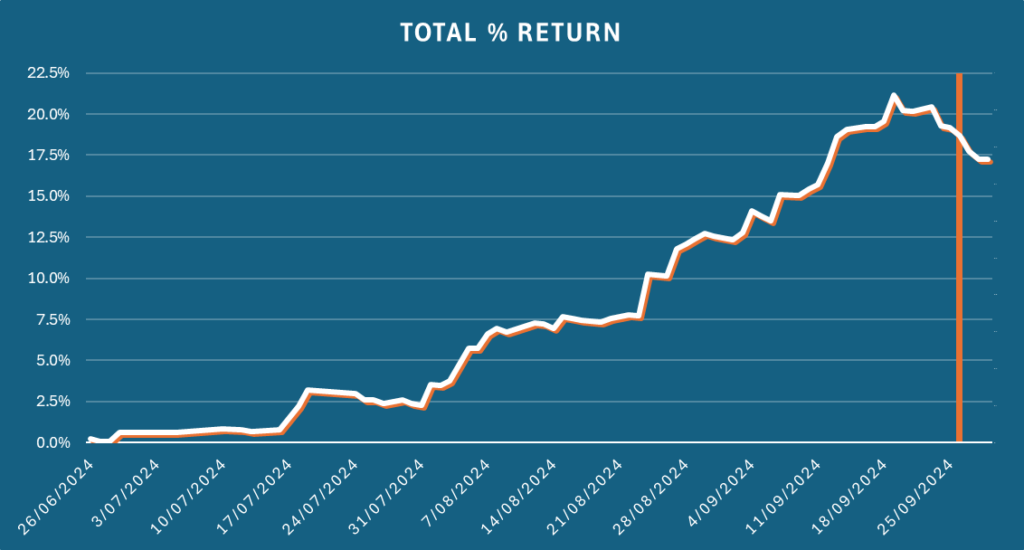

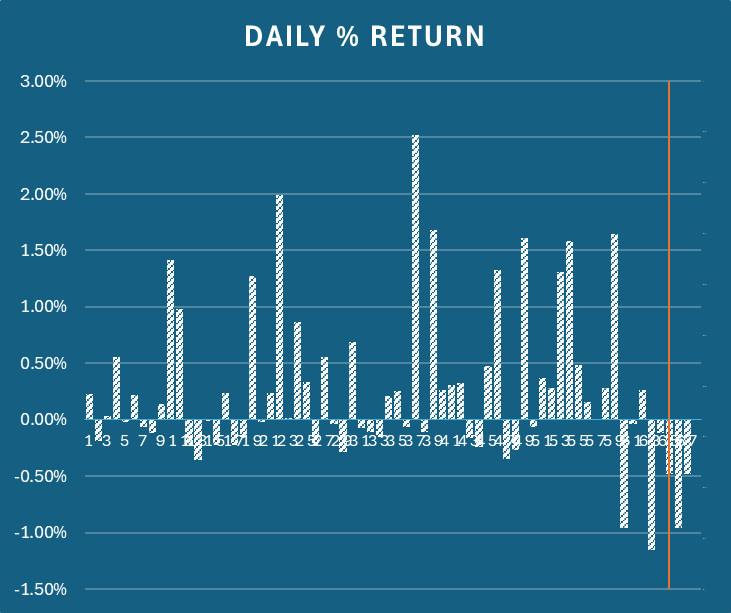

This week’s performance registered a decline of -2.32%, with -0.90% attributed to manual trading and -1.43% to algorithmic trading. We initiated our systematic trading approach this week; however, an initial drawdown has presented an early challenge.

Looking ahead, we anticipate increased volatility in returns, targeting a range of -3% to +5% per week. To safeguard capital, we are implementing a soft stop at -5%, beyond which trading activity will be scaled back to facilitate recovery (note a hard stop of -7% is in place, where we will review the continued interest from all investors)

Below is a 90-day performance snapshot, where the horizontal line marks the transition to live trading. The second chart shows the daily percentage return profile.

It is worth noting the drag from fees remains a problem as capital is still small (effectively costing -0.73% per month)