US:

A late rally helped large-cap stocks secure their fourth consecutive weekly gain, despite rising tensions in the Middle East and a dockworkers’ strike at Eastern seaports. Oil prices surged on Middle East concerns, boosting energy shares, while consumer discretionary and cruise line stocks suffered. Nike also fell after withdrawing full-year sales guidance. Markets were jolted midweek by news of Iran firing missiles at Israel, though they stabilized as worst-case scenarios were avoided. A strong U.S. jobs report on Friday, showing 254,000 new jobs, further buoyed markets but pushed Treasury yields to near two-month highs.

EU:

Expectations for a European Central Bank (ECB) rate cut in October have risen as eurozone growth weakens and inflation drops below the ECB’s 2% target. Headline inflation fell to 1.8% in September, the lowest since April 2021, while core inflation eased to 2.7%. A slightly improved eurozone composite PMI, at 49.6, still signaled contraction. ECB President Christine Lagarde and other officials hinted at potential policy easing, while in the UK, Bank of England Governor Andrew Bailey suggested possible rate cuts, though Chief Economist Huw Pill urged caution.

Fund Performance:

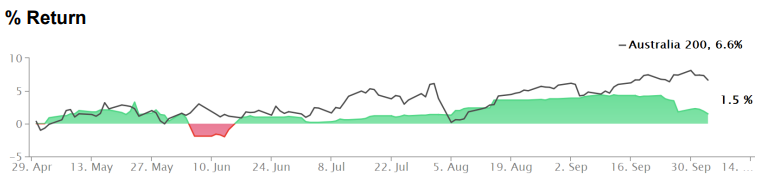

The fund’s performance closed the week with a -0.30% return after navigating a challenging period of heightened volatility, which eroded Monday’s strong start (+0.40%). The primary driver of the week’s loss was the removal of anticipated rate cuts in the Australian market. Despite the setback, I am satisfied with the week’s outcome given the market conditions and remain confident that positive returns are within reach.

Looking ahead, I see a compelling opportunity to allocate capital to a structural position with the potential to generate returns of 5-7% or more over a longer-term horizon.