US:

In the U.S. financial markets last week, major indexes like the S&P 500 and Nasdaq reached new highs, but the gains were narrowly concentrated in technology and growth stocks. This trend persisted for the second straight week, with tech stocks benefiting from optimism around artificial intelligence and Elon Musk’s sizable pay package at Tesla, linked to autonomous driving developments.

Economic indicators showed unexpected stability in inflation, with consumer prices flat in May and core inflation slightly below expectations, easing concerns about rapid price increases. Producer prices also declined, signaling a broader moderation in inflationary pressures. However, an uptick in jobless claims hinted at potential challenges for economic recovery.

Following their meeting, Federal Reserve officials maintained interest rates but adjusted their projections, anticipating a higher federal funds rate by the end of 2024 to combat inflationary risks, despite acknowledging only modest progress in this regard.

Bond markets reacted sharply to the economic data, with yields on 10-year Treasury notes falling significantly. This decline was mirrored in muted activity across municipal and corporate bond markets, influenced by fluctuating investor sentiment and global economic uncertainties.

Overall, the week illustrated a complex economic landscape with mixed signals of growth, subdued inflation, and cautious market reactions to Fed policy and economic indicators.

EU:

Last week in Europe, stock markets faced significant declines amid political uncertainty stemming from strong showings by far-right parties in European Parliament elections. The STOXX Europe 600 Index fell by 2.39%, with major bourses like Italy’s FTSE MIB (-5.76%), Germany’s DAX (-2.99%), and France’s CAC 40 (-6.23%) all experiencing losses. The UK’s FTSE 100 also ended 1.19% lower.

The uncertainty was exacerbated by French President Emmanuel Macron’s call for snap legislative elections following the elections, which showed a shift toward right-wing parties. European Central Bank President Christine Lagarde’s comments on maintaining restrictive monetary policy further added to market caution.

In bond markets, government bond yields saw volatile trading, with French and Spanish 10-year yields reaching their highest levels of the year before retracing slightly by week’s end. France’s 10-year yield surged over 20 basis points due to concerns over the impact of the snap elections on public finances, while German yields fell as investors sought safety amidst the regional uncertainty.

AU:

Australia’s employment figures surpassed expectations as businesses increased hiring, particularly in full-time positions, leading to a decrease in the unemployment rate. This indicates ongoing strength in the labour market despite a stagnant economy.

However, the positive employment report is not expected to prompt immediate interest rate cuts. Market consensus suggests that any easing of monetary policy is likely to commence in the second quarter of the following year.

Fund Performance:

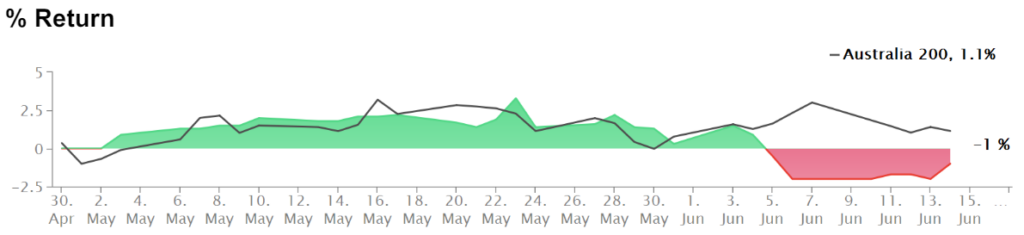

Returns relative to the ASX 200 Index, resulting in -1.3% for the month so far

After a challenging previous week, the fund rebounded with a weekly gain of +1.04%. The market was volatile due to significant data releases, notably the US CPI report on Tuesday and the US Federal Reserve’s decision on Wednesday. Given the unpredictable nature of these events, the decision was made to temporarily suspend trading during such periods to mitigate potential extreme gains or losses.

System Details:

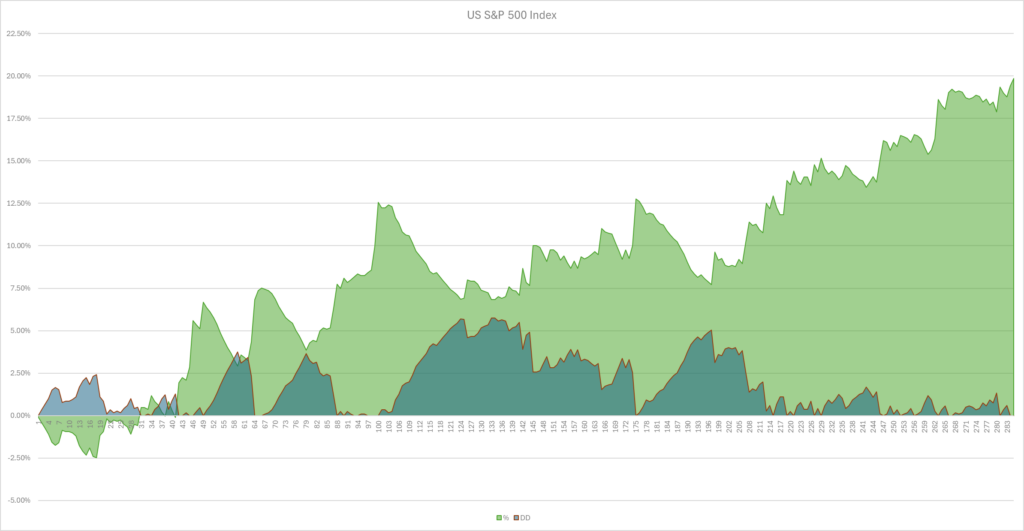

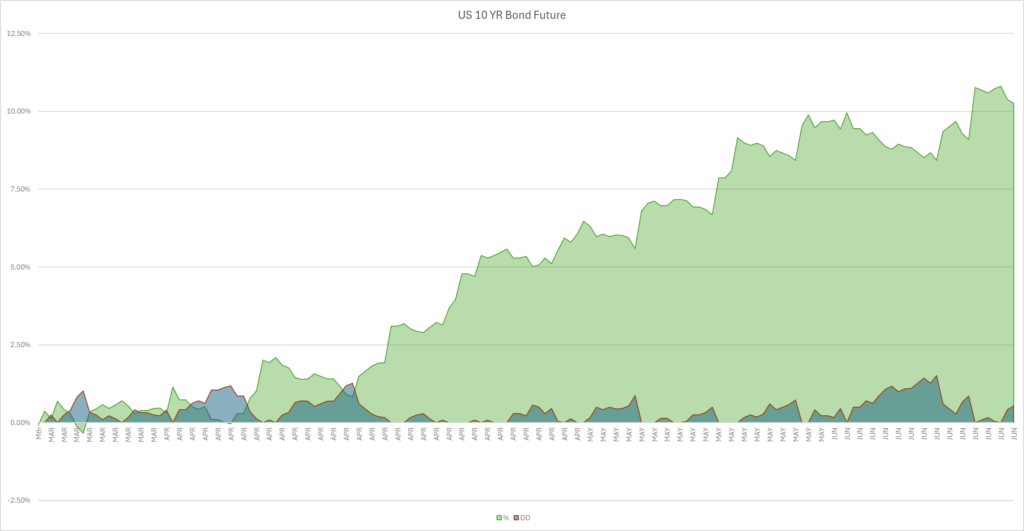

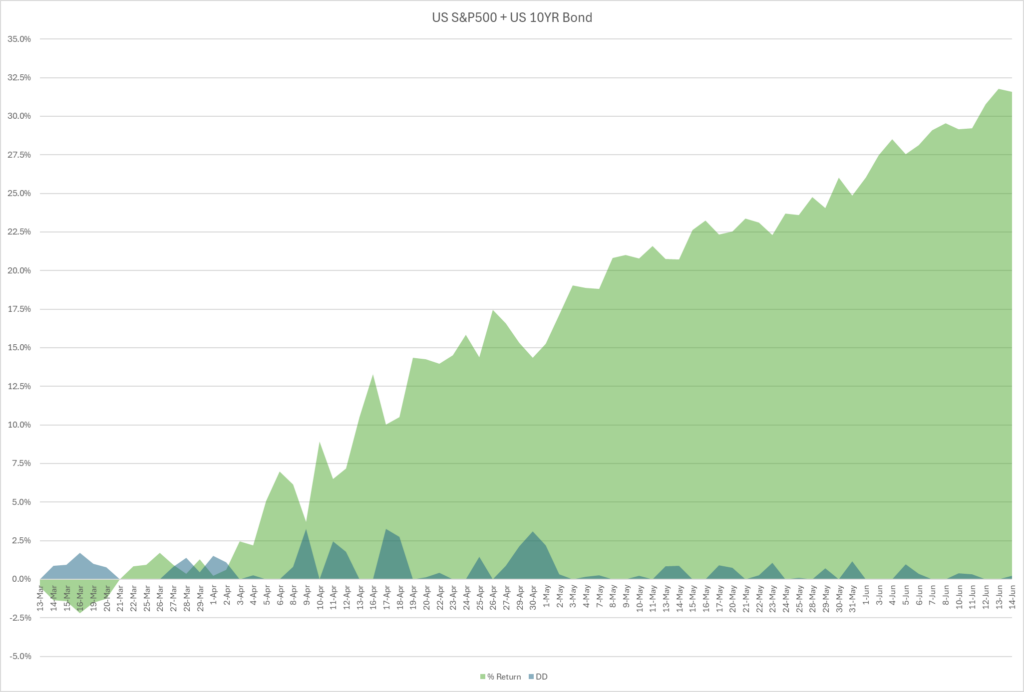

Going forward we are reducing the system focus to the US S&P500 Index and the US 10yr Bond. Mostly of the need to keep risk appropriate to the capital base the fund has at the moment. These products are being used with 1 and 2 contracts. This sees the best performance mix paired with the best diversification. Below is the performance of the two products (green = return, blue = drawdown) over the last 3 months.

*US S&P 500 Index

*US 10yr Bond

Below is the mix of the two systems where we see strong performance along with an improvement in observed drawdown.

Next week, we intend to run the above combination.