US:

U.S. stocks saw modest gains as the S&P 500 hit new highs amidst a market shift favoring value stocks over growth, with major indices outperforming the Nasdaq Composite. Friday marked a significant options expiration day. Economic indicators showed mixed signals: retail sales edged up slightly in May after a decline in April, reflecting cautious consumer spending trends, while industrial production surged unexpectedly, indicating a robust manufacturing sector near full capacity. Business activity also strengthened, particularly in the services sector, with expanding payrolls and stable price pressures. Bond markets saw fluctuating Treasury yields, initially lowering on retail data but recovering later in the week on positive business activity reports. Bond yields remained steady amid heavy corporate bond issuance supported by improved investor sentiment and expectations of potential Federal Reserve rate cuts later in the year.

EU:

The pan-European STOXX Europe 600 Index rebounded by 0.79% in local currency terms as concerns over political uncertainty eased and expectations for monetary policy easing grew. Major European stock indexes saw gains: Germany’s DAX rose 0.90%, France’s CAC 40 increased by 1.67%, Italy’s FTSE MIB climbed 1.97%, and the UK’s FTSE 100 added 1.12%. The Bank of England maintained its key interest rate at 5.25%, with seven members voting for no change and two supporting a cut to 5%, signaling a potential shift towards lowering rates later this year. UK headline inflation reached the central bank’s 2% target in May, down from 2.3% in April, though services inflation remained higher than expected at 5.7%. The Swiss National Bank cut rates for the second consecutive meeting, reducing the policy rate to 1.25%, citing decreased inflation pressures. Meanwhile, Norway’s Norges Bank held its rate steady at 4.5%, anticipating no changes for the remainder of the year before gradual reductions. Eurozone business activity slowed unexpectedly in June, with the Composite PMI dropping to 50.8 from May’s 52.2, driven by weaker services momentum and sharper manufacturing contraction, particularly noticeable in France where new orders decline led to a second consecutive month of output contraction.

AU:

The Australian share market closed slightly higher as the financial year-end approached. The S&P/ASX200 index gained 26.6 points, or 0.34%, to reach 7,796, while the broader All Ordinaries rose 28.4 points, or 0.35%, closing at 8,040.5 on Friday. Over the week, the ASX200 increased by 0.82% following a 1.7% decline the previous week. However, the Reserve Bank of Australia’s decision to keep rates unchanged, despite considering a potential hike, tempered market enthusiasm. economists more broardly noted that while inflation was expected to moderate, uncertainties around future rate movements make the RBA’s August meeting crucial, especially ahead of the June quarter inflation data release on July 31.

Fund Performance:

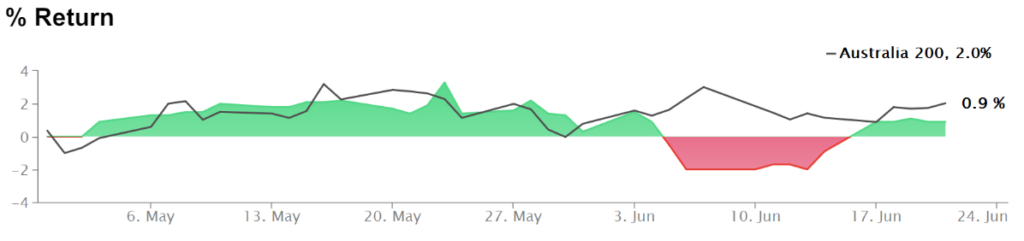

Returns relative to the ASX 200 Index.

Another positive week, marking a gain of 1.79% following a 1.04% increase the previous week. Performance was bolstered by gains in the US S&P500 and expectations for New Zealand interest rates through March 2025. Looking ahead to the coming week, we anticipate action around the AU CPI monthly release, CAD CPI data, and the crucial US “Core PCE” inflation reading. We proceed cautiously, focusing on capital protection with tighter trade execution parameters.