US:

In the U.S. markets, the past week saw overall gains with notable performances from small-cap and technology stocks. This came amidst a relatively quiet period in market news, attributed to anticipation around upcoming second-quarter earnings. Small-cap firms and tech stocks led the gains, particularly growth stocks. The week also featured a strong showing from the banking sector, driven by reports suggesting lighter capital requirements from the Federal Reserve and positive stress test results for large banks, potentially paving the way for increased shareholder payouts.

Economic indicators showed a slowing in core inflation, as the core PCE price index rose modestly, signaling a possible Federal Reserve rate cut in September. Meanwhile, Treasury yields experienced a shift, with longer-term yields rising and short-term yields slightly decreasing, resulting in a steeper yield curve.

EU:

In Europe, the STOXX Europe 600 Index fell 0.72% due to heightened political uncertainty in France ahead of President Macron’s snap election. Germany’s DAX rose 0.40%, Italy’s FTSE MIB dropped 0.46%, France’s CAC 40 declined 1.96%, and the UK’s FTSE 100 eased by 0.89%.

Eurozone government bond yields rose before inflation data releases, influenced by cautious ECB comments on interest rates. The spread between French and German yields widened ahead of France’s June 30 election, while UK yields increased ahead of July 4 elections and on upward revisions to Q1 GDP.

Inflation slowed in France and Spain in June due to lower fuel and food price increases. Germany saw a rise in unemployment to 6.0%, the highest in over three years, alongside weakened business confidence and consumer sentiment.

Eurozone economic sentiment was mixed in June, with a slight decline in the European Commission’s economic sentiment indicator and marginally improved consumer confidence.

AU:

In Australia, the latest CPI figures exceeded expectations, showing a year-on-year increase of 4.0% and core inflation at 4.4%. This development has prompted many banks to revise their forecasts, now indicating a 50/50 likelihood of an interest rate hike occurring in August. As a result of the CPI data, there has been a notable adjustment in the yield curve, reflecting market reactions to the inflationary pressures.

Fund Performance:

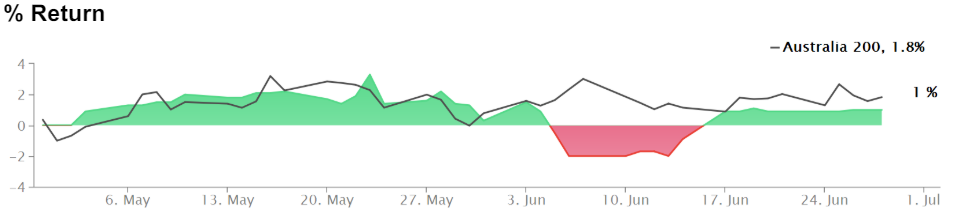

Returns relative to the ASX 200 Index.

It was a positive week, closing with a modest gain of 0.13%. Given the upcoming releases of CAD CPI, AU CPI, and US PCE inflation data, risk exposure remained conservative. The fund prioritized protection over speculative bets on the data outcomes. Looking ahead, we aim to capitalize on asymmetric opportunities in the upcoming week.