US:

In the U.S. markets last week, investor attention shifted towards value and small-cap stocks, leading to a mixed performance across major indexes. The Dow Jones Industrial Average stood out, driven by gains in value shares which outpaced growth stocks significantly. Global disruptions to computer systems on Friday had minimal impact domestically.

Economic indicators were mostly positive, with retail sales, building permits, and industrial production beating expectations. However, jobless claims rose unexpectedly, signaling potential challenges in the labor market. Federal Reserve Chair Jerome Powell noted a balanced outlook on inflation and growth, influencing Treasury yields which fluctuated amid market concerns. Bond markets remained resilient despite increased issuance, reflecting ongoing investor confidence amidst shifting economic signals.

EU:

In Europe, stock markets faced declines as trade tensions between the U.S. and China escalated. The STOXX Europe 600 fell by 2.68%, with Germany’s DAX, France’s CAC 40, Italy’s FTSE MIB, and the UK’s FTSE 100 also recording losses. The European Central Bank (ECB) kept interest rates steady at 3.75%, signaling a cautious approach amidst economic uncertainties. ECB President Christine Lagarde indicated that a rate decision in September was uncertain, citing downside risks to growth and stable inflation expectations. Meanwhile, the UK reported stable headline inflation at 2%, supported by lower energy costs, while strong job market data raised doubts about an imminent rate cut by the Bank of England.

Fund Performance:

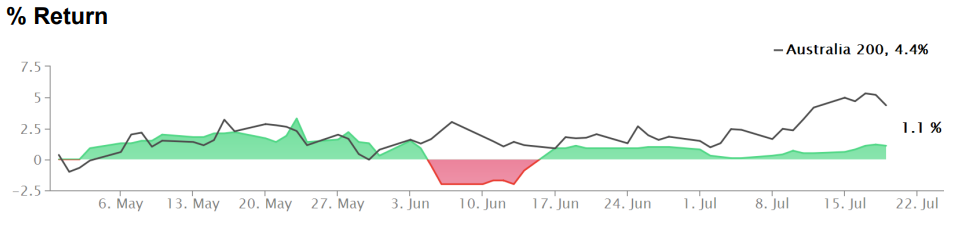

Returns relative to the ASX 200 Index.

During the past week, the fund delivered a gain of +0.63%, driven primarily by short-term trading activities within the US stock market, alongside a strategic position reflecting expectations of interest rate cuts in Australia throughout 2025. Our systematic trading approach continues to be meticulously overseen on a daily basis, ensuring prudent management given our conservative capital base and emphasis on minimizing risk exposure. Looking ahead, we are evaluating option derivatives as a way to gain exposure to the upcoming US election, recognizing their potential for significant payoff asymmetrys.